Startups typically reside and expire by the number of funds received, and within the last 36 months there has been an onslaught of investment decision that nearly more than doubled as 2015 arrived at a detailed.

Startups typically reside and expire by the number of funds received, and within the last 36 months there has been an onslaught of investment decision that nearly more than doubled as 2015 arrived at a detailed.

But that rock and roll-reliable improvement is commencing to show fractures, as the number of startups that gotten financing, and the level of financing determined, fell by 11% inside the initial quarter compared to a calendar year in the past, as reported by the just lately published MoneyTree Report from PricewaterhouseCoopers LLP along with the National Venture Capital Association, depending on details from Thomson Reuters.

But that rock and roll-reliable improvement is commencing to show fractures, as the number of startups that gotten financing, and the level of financing determined, fell by 11% inside the initial quarter compared to a calendar year in the past, as reported by the just lately published MoneyTree Report from PricewaterhouseCoopers LLP along with the National Venture Capital Association, depending on details from Thomson Reuters.

Why Startup Venture Capital Is No Friend To Small Business

Venture capitalists sunk $12.1 billion into 969 startups on the very first quarter, lower coming from the virtually $13.7 billion dollars elevated a year ago in 1,085 offers. And ought to the remainder of 2016 continue on a similar path, it can slip significantly short of the $59.7 billion bought 2015 in 4,497 offers. Unfortunately for any marketplace, business capitalists and industry experts are wanting exactly that in 2016.

"I think our company is going to a slowdown when compared to 2014 and 2015, but it surely will reach the quantities that individuals were a lot more used to," says Tom Ciccolella, U.S. venture funds market leader at PwC. "A a lot more standard sum lifted could well be fewer than $40 billion."

Five Reasons Your Startup VC Is Not What It Could Be

And in the last two decades, the total number of businesses that have received business funds has averaged about 4,000 each year, or about 1,000 a quarter, Ciccolella provides.

Fall from Record Highs

The quantity of discounts funded in the initial quarter was somewhat much softer when compared to the cultural ordinary of one thousand a quarter. Additionally, the number of mega-money promotions, when a start-up is provided with $100 zillion or maybe more in a quarter, dropped sharply in the initial 3 months of the season, Ciccolella information. The first quarter received 10 super-money discounts, such as a $1 billion dollars financing around for ridesharing company Lyft. But the total number of mega-funds discounts is downwards from roughly 75 a year ago and 50 in 2014, Ciccolella suggests.

"There is really a essential pullback at the end of-phase and development promotions, and you will definitely look at it within the information inside the coming weeks."-Venky Ganesan

My Life, My Job, My Career: How Ten Simple Venture Capital Helped Me Succeed

Other situations that helped to gradual the financing fee during the initially quarter incorporated a lot less require from in the past financed startups.

Warning: These 9 Mistakes Will Destroy Your Startup VC

"When you are going about [Silicon] Valley, one reason why offer circulation is downwards is a lot of businesses are on a big slice of alter," Ciccolella states that. What’s even more, when comparisons with today’s concentrations are increasingly being produced, it’s well worth keeping in mind that recent years "have witnessed file-higher levels of fundraising."

Additionally, low-classic purchasers pulled back on start up funding within the 1st quarter, a segment of non-project budget brokers that also includes hedge resources, non-public home equity agencies and corporate purchasers. Element of the pullback from low-typical purchasers was linked to a refocusing on investors’ key enterprises, based on the MoneyTree document.

Luke Taylor, a financial professor at Wharton, notes that non-traditional purchasers have largely been involved with the more grown up, delayed-period startups. "If these shareholders walk away, it won’t have a lot of an impact on earlier-point businesses. Should it have an effect on overdue-level providers? Possibly, but possibly not very very much."

The very best effect is going to be on firms that are taking their time heading open public within an IPO. With no included assistance of non-regular investors, a few of these providers may choose to accessibility everyone market segments sooner rather then after, Taylor contributes.

Sizing up 2016

That pullback from non-standard brokers is expected to improve during the remainder of the year or so, affirms Venky Ganesan, a controlling director with Menlo Ventures. "I expect conventional VCs to carry on everyday life as ordinary. The no-typical participants, hedge finances, sovereign wealth capital, etcetera., will even so cross over from the market place."

Want To Have A More Appealing Venture Capital? Read This!

The Fed’s signaling of a soaring interest weather conditions is likely to cause it to more attractive for these non-standard investors to bear in mind re-assigning their money when it comes to interest-relevant investments, rather than startups.

8 Solid Reasons To Avoid Startup Venture Capital

Tim Draper, founding father of Draper Associates, DFJ and Draper University, wants the quantity of backing to remain level or decrease 5% quarter through quarter for that remainder of the year. But valuations will likely increase 20% during the year.

Ten Essential Elements For Startup Venture Capital

Potentially and helps to prop up valuations: a powerful industry and also the very first of profitable IPOs. A supervisor of IPO-focused ETFs, the improving market place situations may bode properly for four IPOs slated to lift virtually $1.5 billion dollars.

, according to Renaissance Capital>"Unicorns obtained a little bit in advance of their selves because there was so very much enthusiasm regarding brand name sizzle. I do believe valuations are about at this time."-Tim Draper

Things You Should Know About Startup VC

Meanwhile, unicorns — startups that possess a valuation of $1 billion dollars if not more in personal trading markets — could see their herd thinned in the current 12 months as purchases in these large-valuation providers grows more credible, as suggested on this Knowledge@Wharton article in January.

Venture capitalists who invested in past due-step startups like unicorns gained a wake-up bring in the earliest quarter. "Growth at all costs was no longer satisfactory, and item business economics begun to matter once more," Ganesan indicates. "There has become a substantial pullback in late-step and extension promotions, and you will probably view it from the information from the arriving months."

Late-point and growth investment strategies currently declined 23% to $7.5 billion within the initial quarter, in contrast using the same time a year ago. Based on the MoneyTree document.

, that is in sharp contrast to seed- and early-stage investments, which rose 17.7% to $4.6 billion in the quarter compared with year-ago figures>"Unicorns obtained a little prior to themselves because there was so significantly thrills with regards to their brand name sizzle. I do believe valuations are about right now," states that Draper. What’s additional, most unicorns are quite perfectly financed and they are not actively looking for extra money at this time.

Tactics for Entrepreneurs

Using a tightening up backing environment prone to engulf startups this season, really should enterprisers be concerned?

"They need to totally be nervous," suggests Taylor. "There’s lots of uncertainty at this time precisely how tricky it will likely be to lift VC dollars in the future. Should they fail to bring up VC finance."

, most of these companies will run out of cash and shut down>They ought to be taking action, claims Ron Berman, a professor of marketing at Wharton, having composed a document about the impact of expenses on the startup’s emergency., even though

Not only should really internet marketers be concerned>

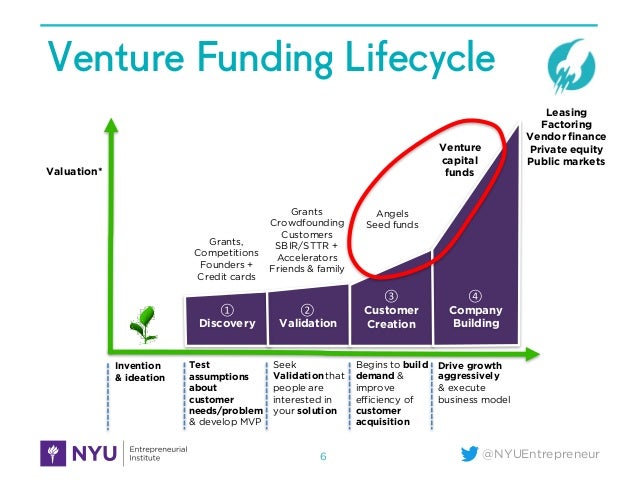

"In standard, it may be suggested for business owners to perform one among two things," remarks Berman. "If they are about to finish off fundraising, they should aspire to boost a greater quantity than intended, since upcoming chance for fundraising might not exactly are available rapidly. This strategy is distinct in comparison to the former technique of boosting an exceptionally smaller pre-seed or seed rounded, having traction and choosing greater rounds."

However, in case a start-up is not really at this time in the operation of rearing capital or perhaps less likely to achieve this soon, then it is imperative that you prioritize profits and verify this company unit rather then investing in researching or system growth, Berman suggests. The optimal associated with this plan is usually to possibly boost the startup’s treatments or generate gross sales thru promoting.

Warning: These 6 Mistakes Will Destroy Your Startup Malaysia VC

But the majority of internet marketers, nonetheless, nevertheless have faith in constructing a lowest viable merchandise (MVP), then raising the cash to develop it towards a complete merchandise, Berman clearly shows. This tactic might benefit a promptly escalating services startup, which has a confirmed business design from day 1. However, if it is not the case, the startup really should focus on the enterprise model, together with the customer purchase procedure and the benefit chain.

A price chain pinpoints how benefit is done with the startup’s products or services, brings Berman. For example, underneath Uber’s importance sequence, the operator is provided with some benefit in the cabability to make use of their own idle car or truck and cell phone to generate money. For Uber’s shoppers, the worth is definitely the lower-cost of journey, even more availability of automobiles and the cabability to use a cellphone to hail a drive.

In examining the benefit chain, a money worth is placed on all the motorist and also the traveler values.

"There’s many uncertainty right now about how challenging it will be to raise VC cash sooner or later. These types of firms will exhaust your dollars and shut down as long as they forget to boost VC credit."-Luke Taylor

"Many startups develop a provider and that is extremely helpful for consumers, however are truly reluctant to pay very much for doing it - therefore, you will find a chain of producing a product or service, however it has small benefit," Berman point out.

Areas Grabbing VC Attention

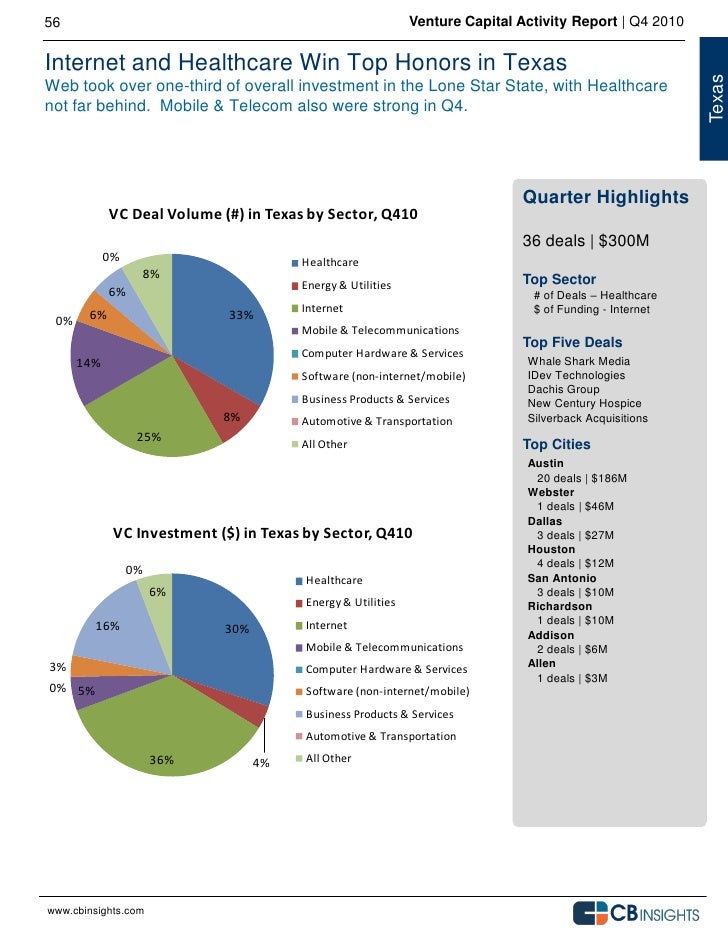

Software has historically grabbed the most significant piece of business financial investment, plus in the primary quarter that remained the situation, in accordance with the MoneyTree Report. Software new venture investment strategies made up 42.1Per cent of your $12.1 billion put in.

During the last 24 months, assets on the net of Things (IoT), bots, internet truth and augmented real life have already been solid, claims Ciccolella. "The 4th pillar of the modern technology transformation — from your PC to the web to cell — is augmented and virtual simple fact."

Draper also cites IoT like a warm sector which is drawing VC awareness, along with regions that he or she exclusively loves like modern technology for government departments (GovTech), financial services (FinTech) and also the health-related sector (MedTech).

Ganesan, in the mean time, mementos text messaging crawlers, cyber-drone and safety-related investment strategies. But there is one area he views bulletproof in regards to weathering changes in the financial state: "The most macro-resistant market are going to be (software-as-a-support) SaaS, given that containing ongoing earnings, which is certainly foreseeable."

And also the seed-phase stage, health and fitness engineering, stats tracking, social media marketing and online store are any type of startups that generally pitch on the M&T Innovation Fund, which is supported by the University of Pennsylvania and also the Jerome Fisher Engineering and Management Program.

Marriage And Startup VC Have More In Common Than You Think

The account, trainees-run surgery from the M&T system, presents no-collateral cash permits up to $4,000 to startups manage by present Penn learners or recently available MAndT alumni, explained Robert Lawrence, co-go with the fund’s investment decision team. Because the fund was made in 2015, there are dedicated to 10 startups. The fund aims to purchase your five endeavors each and every year.

In determining the all around environment for VCs, Berman affirms the slowdown in money may not actually be a bad thing for startups. "This is likely to make firms additional sturdy, and will ensure better worthy companies get financed.

jana_fournier@bigstring.com

jana_fournier@bigstring.com